Union Minister of state for electronics and IT Rajeev Chandrasekhar highlighted the importance of regulatory compliance for fintech firms, stating that the Paytm Payments Bank case has drawn attention to this issue. In an interview with PTI, he emphasized that non-compliance can have detrimental consequences for entrepreneurs in the digital economy.

Ruchit Jain advises caution in betting on a broad rally in India's state-owned firms. Recent earnings of SJVN Ltd and Rail Vikas Nigam Ltd offer little support. Jefferies sees potential for re-rating due to governance improvements, infrastructure spending, and maximizing value of state assets. For now, the PSU index’s relative strength index — a gauge of price momentum — is at the highest level in more than two decades.

The rupee rose 4 paise to 83.01 against the US dollar in early trade on Friday, tracking positive cues from domestic equity markets. Forex traders said a strong American currency and elevated crude oil prices, however, weighed on the local unit. At the interbank foreign exchange, the domestic currency opened at 83.03 and inched up to 83.01 against the greenback in initial deals.

Malaysia's economy in the fourth quarter of 2023 grew 3% from a year earlier, below expectations, government and central bank data showed on Friday. Economists surveyed by Reuters had forecast gross domestic product growth would come in at 3.4% in the October to December period, slightly more than the 3.3% expansion in the third quarter.

Cognizant's headcount decreased by 7,600 employees to 3.4 lakh employees in 2023. The company saw reductions in India and onsite. It expects costs due to the NextGen programme. It is using AI-based technologies, acquired Thirdera, and includes software sales in its P&L.

RBI governor Das recommends the Indian strategy to address inflation, citing risk of sovereign indebtedness and financial instability. India's policy response can serve as a template for countries amid adverse shocks. Challenges in the disinflation process were discussed at the SEACEN Governors' Conference. Concerns about growth and macroeconomic stability were raised due to the pandemic and existing debt burdens.

Few people have expressed concern that the regulatory action against Paytm Payment Bank will cause significant market disruptions. Paytm may be a visible payment tool, but the RBI's restrictions on depositing funds in accounts or instruments issued by the payment bank, which begin next month, are expected to be far lower than previously anticipated.

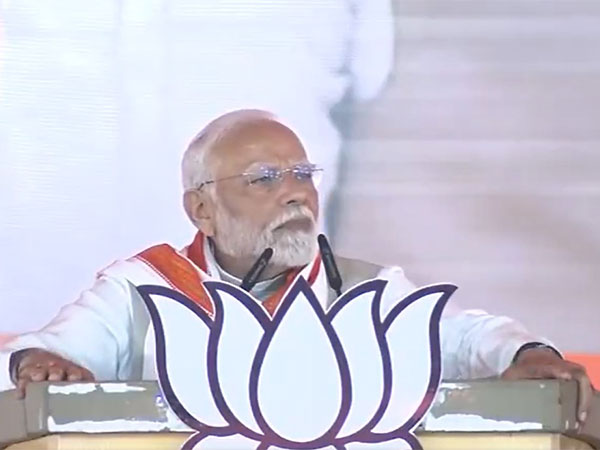

On Thursday, a program to empower India's 'Yuva Shakti' was launched, with the goal of reviving young skill development. Towards this goal, the government formed a variety of industrial agreements with firms such as Google, Microsoft, Flipkart, Teamlease, Upgrad, Reliance Foundation, and Infosys.

The Reserve Bank of India has struck an agreement with Nepal's central bank to integrate UPI with the country's national payment interface. The signing comes two years after the National Payment Corporation of India's international arm signed an agreement to support UPI rollout in Nepal. The agreement was inked in the presence of RBI governor Shaktikanta Das and his Nepali counterpart Maha Prasad Adhikari.