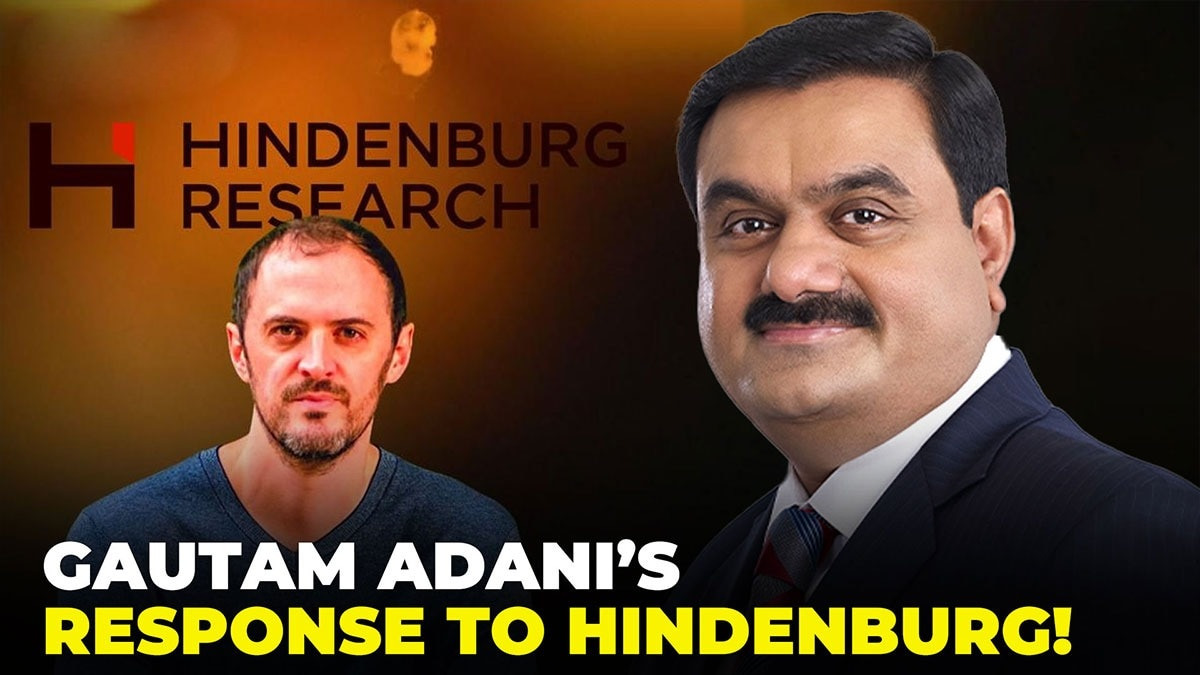

The shares of Adani Power among all other Adani Group stocks grabbed attention on Tuesday, January 14, as they witnessed a significant surge in volumes, going as high as 19.3% in intraday trade.Adani Power stock rose most among the group, surging as much as 19.3% to Rs 537.Adani Energy Solutions stock surged 14.4%, touching its intraday peak of Rs 787.50 on the BSE, while other notable performers included Adani Total Gas and Adani Green Energy, both hitting their upper circuit limits in early trades.Adani Total Gas shares hit their upper circuit with a 10% increase to Rs 691.05, while Adani Green Energy shares later surged 14.5% to Rs 1,019.35.Shares of Adani Enterprises experienced a substantial increase of 9%, reaching Rs 2,422.10. Meanwhile, Adani Ports shares recorded a gain of 6%, fol